Research Interests

- Innovation

- Competition Policy

- Multinational Enterprises

Current Research

The Breakup of Bell and its Impact on Innovation

with Martin Watzinger, University of Muenster

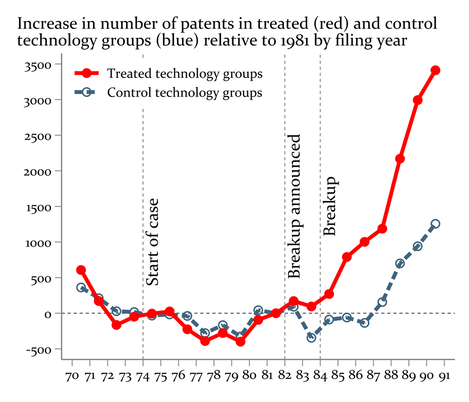

We analyze the effects of the 1984 breakup of the Bell System on the rate, diversity, and direction of US innovation. In the antitrust case leading to the breakup, AT&T, the holding company of the Bell System, was accused of using exclusionary practices against competitors. The breakup was intended to end these practices. After the breakup, the scale and diversity of telecommunications innovation increased. Total patenting by US inventors related to telecommunications increased by 19%, driven by companies unrelated to the Bell System. Patenting by Bell’s successor companies decreased, but not the number of top inventions.

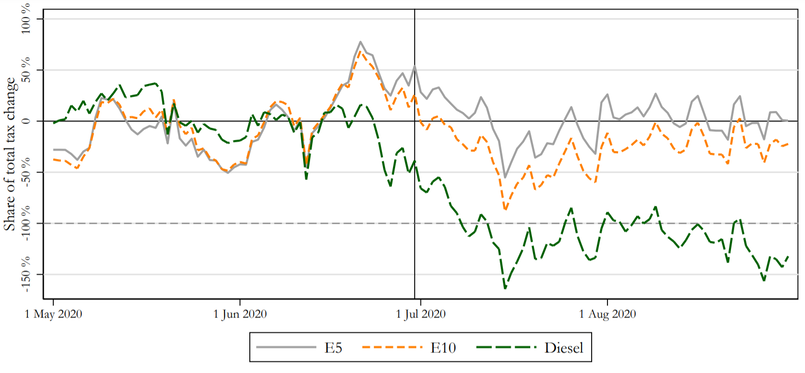

Imperfect Price Information, Market Power, and Tax Pass-Through

Pass-through determines how consumers respond to taxes. We investigate the impact of imperfect price information on pass-through of commodity taxes. Our theoretical model predicts that the pass-through rate increases with the share of well-informed consumers. Pass-through is higher for the minimum price, paid by well-informed consumers, than for the average price, paid by uninformed consumers. Moreover, passthrough to the average price is non-monotonic with respect to the number of sellers. An empirical analysis of multiple recent tax changes in the German and French retail fuel markets confirms our theoretical predictions. Our results have implications for tax policy and shed light on the relative effectiveness of Pigouvian taxes versus regulation.

VAT reduction as unconventional fiscal policy in Germany:

Fast but heterogeneous pass-through in the fuel market

with Felix Montag and Alina Sagimuldina

An updated version of this paper with the title "Imperfect Price Information, Market Power, and Tax Pass-Through" can be found above.

Standing on the shoulders of science

Download / HBS working paper / CEPR Discussion Paper / VoxEu / Patent novelty data / Accepted for publication in Strategic Management Journal

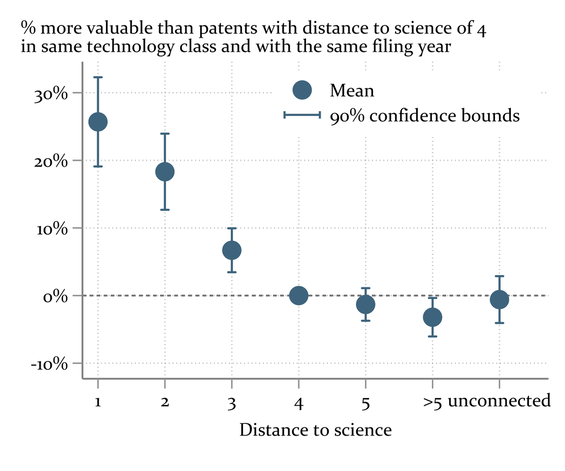

Today's innovations rely on scientific discoveries of the past, yet only some corporate R&D builds directly on scientific output. In this paper, we analyze U.S. patents to investigate how firms generate value by building on prior art ``closer" to science and establish three new facts about the relationship between science and the value of inventions. First, we show that patent value is decreasing in distance-to-science. Patents building directly on scientific publications are on average 26% more valuable than patents in the same technology which are disconnected from science. Patents closer to science are also more likely to be in the tails of the value distribution (i.e., greater risk and greater reward). Next, we use patent text analysis to show that patent value increases with patent novelty. Third, we find that science-intensive patents are more novel. We discuss firm heterogeneity and the causes behind the science premium. Overall, firms that consistently use science for invention produce higher value patents generally, and especially when they ``build on the shoulders" of their own scientific work.

How antitrust can spur innovation: Bell Labs and the 1956 consent decree

Download / VoxEU/ Link to CEPR Discussion Paper / Link to published version (complimentary access)

AEJ: Policy 12.4 (2020): 328-59.

Winner of the AEJ Best Paper Awards

Media: New York Times / Latest Thinking / Stanford Law Revice / The Register / Fast Company / American Progress / The Conversation

AEJ: Policy 12.4 (2020): 328-59.

Winner of the AEJ Best Paper Awards

Media: New York Times / Latest Thinking / Stanford Law Revice / The Register / Fast Company / American Progress / The Conversation

Is compulsory licensing an effective antitrust remedy to increase innovation? To answer this question, we analyze the 1956 consent decree which settled an antitrust lawsuit against Bell, a vertically integrated monopolist charged with foreclosing the telecommunications equipment market. Bell was forced to license all its existing patents royalty-free, including those not related to telecommunications. We show that this led to a long-lasting increase in innovation but only in markets outside the telecommunications industry. Within telecommunications, where Bell continued to exclude competitors, we find no effect. Compulsory licensing is an effective antitrust remedy only if incumbents cannot foreclose the product markets.

Publications

- Fostering the Diffusion of General Purpose Technologies: Evidence from the Licensing of the Transistor Patents (with Martin Watzinger and Markus Nagler), Journal of Industrial Economics, 70.4 (2022): 838-866.

- Measuring the Spillovers of Venture Capital (with Martin Watzinger), The Review of Economics and Statistics, 104.2 (2022): 276-292.

- How antitrust can spur innovation: Bell Labs and the 1956 consent decree (with Martin Watzinger, Thomas Fackler and Markus Nagler), American Economic Journal: Economic Policy, 12.4 (2020): 328-59.

- Big Banks and Macroeconomic Outcomes: Theory and Cross-Country Evidence of Granularity, (with Franziska Bremus, Claudia Buch and Katheryn Russ), Journal of Money, Credit and Banking, 2018, vol 50(8), 1785-1825

- “Multinational Firms and Tax Havens” (with Anna Gumpert and James Hines), Review of Economics and Statistics (2016), Vol. 98 (4), 713-727

- “Trade liberalization and credit constraints: Why opening up may fail to promote convergence” (with Katrin Peters), Canadian Journal of Economics (2015), Vol. 48(3), 1099-1119

- “Trade Credits and Bank Credits in International Trade: Substitutes or Complements?” (with Martina Engemann and Katharina Eck), World Economy, (2014), 1507-1540.

- “Financial Constraints and Foreign Direct Investment: Firm-Level Evidence” (with Claudia Buch, Iris Kesternich and Alexander Lipponer), Review of World Economics, 150 (2014), 393-420.

- “Financial Constraints and Innovation: Why Poor Countries Don’t Catch Up” (with Yuriy Gorodnichenko), Journal of the European Economic Association, (2013), 1115-1152

- “Successive Oligopolies with Differentiated Firms and Endogenous Entry” (mit Markus Reisinger), Journal of Industrial Economics, 60 (2012), 537-577

- “When is FDI a Capital Flow?” (mit Dalia Marin), European Economic Review, 55 (2011), 845-861

- “Creditor Rights and Debt Allocation within Multinationals” (mit Basak Akbel), Journal of Banking and Finance, 35 (2011), 1367-1379

- "Who is Afraid of Political Risk? Multinational Firms and their Choice of Capital Structure", (mit Iris Kesternich), Journal of International Economics , 82 (2010), 208-218, Mathematical Appendix

- “FDI and Domestic Investment: An Industry Level View” (mit Christian Arndt und Claudia Buch), Berkeley Electronic Journal of Economic Analysis and Policy, (2010)

- "Entry of Foreign Banks and their Impact on Host Countries", (mit Maria Lehner), Journal of Comparative Economics, 36 (2008), 430-452

- "Organization of Multinational Activities and Ownership Structure" (mit Christian Mugele), International Journal of Industrial Organization, 26 (2008), 1274-1289

- "Technology transfer and spillovers in multinational joint ventures", (mit Thomas Müller), Journal of International Economics, 68 (2006), 456-468, (Appendix)

- "Disorganization and Financial Collapse", (mit Dalia Marin), European Economic Review, 49 (2005), 387-408

- "Die Privatisierung in Osteuropa: Strategien und Ergebnisse", Perspektiven der Wirtschaftspolitik, 4(3) (2003), 359-377

- "Public Subsidies for Open Source? Some Economic Policy Issues of the Software Market", (mit Klaus Schmidt), Harvard Journal of Law and Technology 16(2) (2003), 473-505

- "Creating Creditworthiness through Reciprocal Trade" (mit Dalia Marin), Review of International Economics, 11(1) (2003), 159-174

- "The Economic Institution of International Barter" (mit Dalia Marin), Economic-Journal, 112 (2002), 293-316

- "Debt vs. Foreign Direct Investment: The Impact of Sovereign Risk on the Structure of International Capital Flows", Economica, 69 (2002), 41-67

- "Comment on: Some Simple Economics of Genetically Modified Food, Comment" , (by Dietmar Harhoff, Pierre Régibeau and Katharine Rocket), Economic Policy, 33 (2001), 292-293

- "Comment on: The Process of China's Market Transition (1978-1998): The Evolutionary, Historical, and Comparative Perspectives, Comment", (by Yingyi Qian), Journal of Institutional and Theoretical Economics, 156 (2000), 172-174

- "Enterprise restructuring and bank competition in transition economies", Economics of Transition, 7 (1999), 133-155

- "On the role of bank competition for corporate finance and corporate control in transition economies", Journal of Institutional and Theoretical Economics, 155 (1999), 22-46

- "Expropriation and Control Rights: A Dynamic Model of Foreign Direct Investment", International Journal of Industrial Organization, 17(8) (1999), 1113-1137

- "Economic Incentives and International Trade" (mit Dalia Marin), European Economic Review, 42 (1998), 705-716, wiederabgedruckt in "The Economics of Barter and Countertrade", herausgegeben von Rolf Mirus and Bernard Yeung, Edward Elgar, 2001

- "Hostile versus Friendly Takeovers", Economica, 63 (1996), 37-55

- "Tying Trade Flows: A Theory of Countertrade with Evidence" (mit Dalia Marin), American Economic Review, 85 (1995), 1047-1064, wiederabgedruckt in "The Economics of Barter and Countertrade", herausgegeben von Rolf Mirus and Bernard Yeung, Edward Elgar, 2001

- "Breach of Trust in Takeovers and the Optimal Corporate Charter", Journal of Industrial Economics, 43 (1995), 229-259

- "The Interaction of Explicit and Implicit Contracts" (mit Klaus Schmidt), Economic Letters, 48 (1995), 193-199

- "Countertrade aus vertragstheoretischer Sicht: Theorie und Evidenz" (mit Dalia Marin), ifo-Studien: Zeitschrift für empirische Wirtschaftsforschung, 41 (1995), 119-134

- "Dynamic Duopoly and Best Price Clauses", Rand Journal of Economics, 25 (1994), 186-196

- "Privatization and Management Incentives in the Transition Period in Eastern Europe" (with Klaus Schmidt), Journal of Comparative Economics, Vol.17 (1993), 264-287.

Books

- "Contracts in Trade and Transition: The Resurgence of Barter" (with Dalia Marin), Cambridge and London: MIT Press, 2002